See This Report about House Buyers New York

Our We Buy Houses New York City Statements

Table of ContentsNew York Home Buyers Things To Know Before You BuyThe Only Guide for We Buy Houses New York CityTop Guidelines Of Sell Your House For Cash New York CityExcitement About Sell My House Fast New York City

If the customer later on struggles to make settlements on the home loan, the VA can negotiate with the lending institution on the person's part. Certain lenders supply newbie homebuyers with advantages that are sponsored by the federal government - https://www.slideshare.net/simplybo1dre. New buyers with low- to moderate-income degrees might certify for grants or loans that don't call for settlement as long as the customer stays in the home for a particular period of time.5 years of ages. The acquisition does not require to be a conventional home for the private to certify as a new homebuyer, but it needs to be the individual's major residence. It can be a houseboat that will certainly be used as a residence. The maximum quantity that might be dispersed from the individual retirement account on a penalty-free basis for this purpose is $10,000.

For married couples, the limit uses separately to each spouse. This implies that the combined limit for a married couple is $20,000. The definition of a first-time homebuyer is not as simple as it appears. Government Housing and Urban Development agency programs specify a newbie property buyer as someone who hasn't possessed a home for 3 years before the purchase of a house.

5%. A 10% or 20% money deposit is a formidable barrier, specifically for new property buyers who do not have any kind of home equity. The Federal Real Estate Authority (FHA) has actually been guaranteeing lendings to new purchasers, to name a few, since 1934. At the time, the united state was a nation of occupants. Home loans were available just to the most deep-pocketed customers and were limited to concerning half of the property's value.

The Best Strategy To Use For Cash For Houses New York City

Having graduated from college a few years ago, I really did not believe it was possible to buy a home with my outstanding student lendings. Virginia Housing made it feasible with a grant. I could not think these were offered to novice homebuyers without settlement."

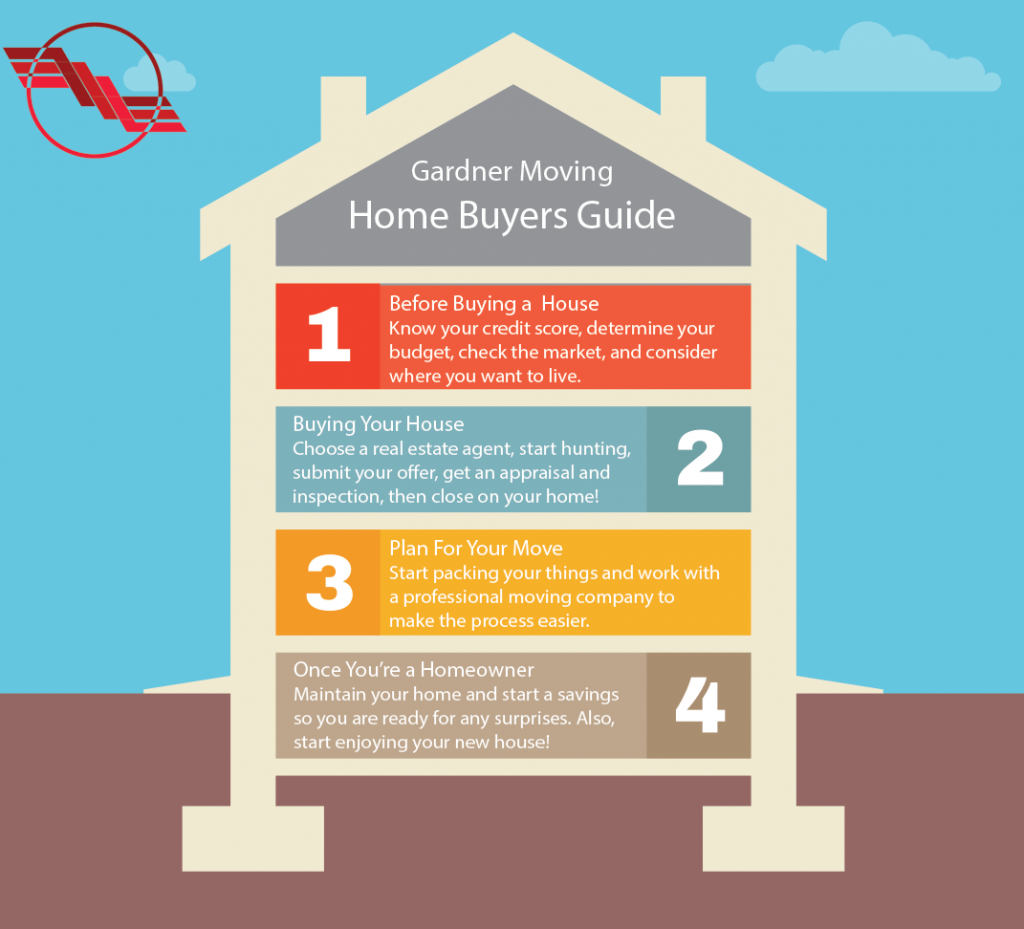

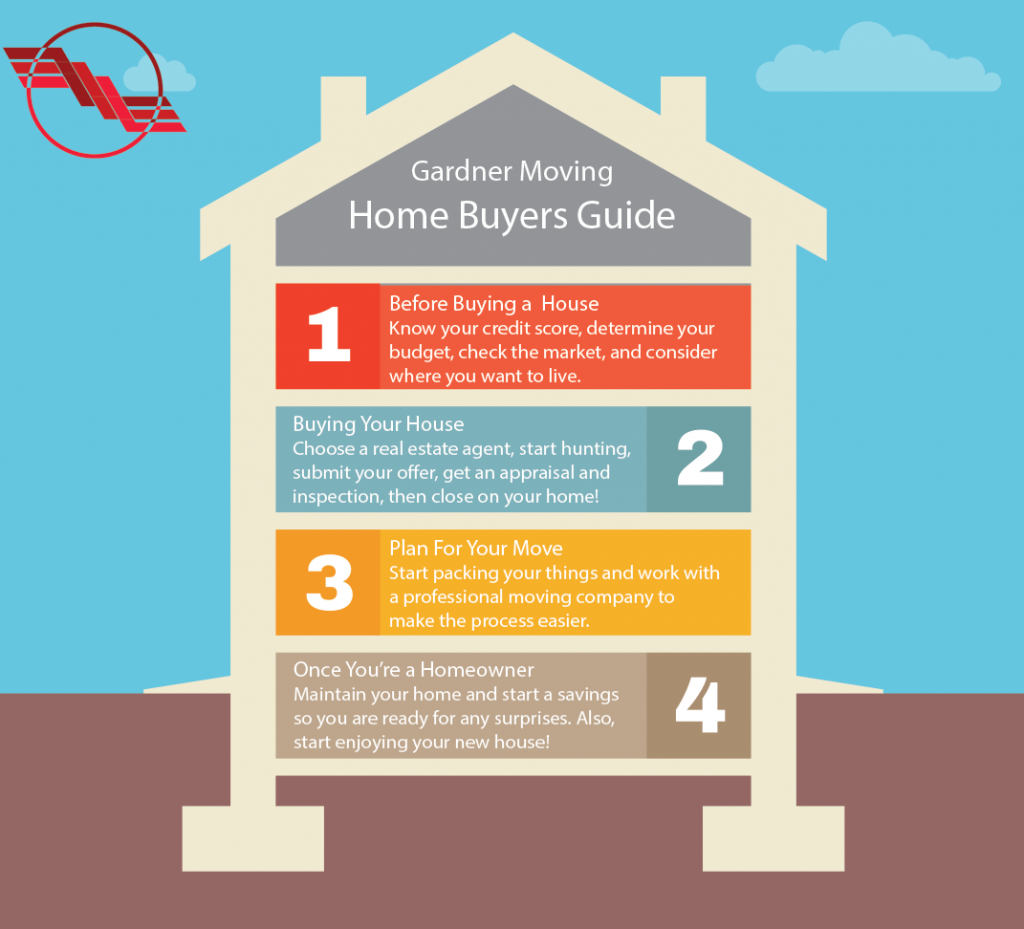

The following is a table of materials for the Home Buyers Manual (https://www.4shared.com/u/C0NXfsRk/simplybo1dre.html). You might click on the headers for additional information on that subject. Can You Afford a Residence? Pre-Qualify for a Financing What's Your Cost Range? Determine What You Can Manage What Do Lenders Want from You? What Is Underwriting? What Do You Desire in a Home? Needs and Wants Checklist Discrimination and Fair Loaning Browse Through Open Houses Several Listing Service (MLS) Available For Sale by Proprietor Publications Shopping the Classifieds The Home Inspection Making a Deal Understanding the Acquisition Agreement Mediation Where Do You Find a Lending institution? Resources for Low-Income Buyers Will You Need Home Mortgage Insurance Coverage? How Can You Get the Lowest Financing Rate Possible? The Residential Or Commercial Property Appraisal Understanding Your Car Loan Payment Beware of Abusive and Predatory Borrowing How to Avoid the Closing Blues What is Homesteading? What Insurance policy Do You Need to Buy Closing Checklist Equal Credit Rating Possibility Act Minnesota Civil Rights Act Property Settlement Procedures Act (RESPA) Funding Transfers Closing Disclosure Fair Credit Click Here Rating Coverage Act. house buyers new york.

Homebuyer gives are made to offset some or all of the investing in expenses for newbie purchasers. They commonly cover part of a down settlement, closing expenses, or in some cases, also the overall purchase rate of the home. They do not call for payment, as long as you live in your home for a required duration of time.

The Cash For Houses New York City Ideas

government doesn't offer them straight. Rather, these funds are passed on to specific states, regions, and towns, which then develop grant programs for residents within their territories. You have several options if you're struggling to conserve up for a down payment, or if you're wanting to lower the expenses of buying a home.

There are some essential details of the NHF grant: You should utilize a getting involved lending institution to qualify. You must have the ability to utilize it with any type of lending kind, Federal Real estate Management (FHA), Department of Veterans Affairs (VA), United State Department of Agriculture (USDA), or traditional. You need to reside in the home for a minimum of three years.

They can vary, depending upon the state in which you purchase. You could potentially be required to take a buyer education training course prior to declaring your credit score. If you aren't acquiring for the very first time, you can still be eligible as long as you're purchasing a residence in a HUD-approved location.

How Sell Your House For Cash New York City can Save You Time, Stress, and Money.

VA and USDA loans are mortgage programs, not assistance programs, however both can assist you stay clear of requiring a pricey down payment. You'll pay a 2% guarantee charge with a USDA car loan, however it can be rolled right into your financing and spread across your monthly mortgage repayments. VA finances are supplied just to army participants and experts.

Different grant programs have various eligibility and application requirements. It assists to start by calling your state company for housing grants, which can attach you with regional give firms that can assist you with the application procedure (house buyers new york). From there, you can complete required applications and send your financial and history info to identify if you certify

You may need to fulfill certain continuous requirements to receive your grant, however settlement isn't one of them. A lot of grants just fund a section of your home purchase, so you will most likely still need a lending also if you get a grant.